Estimate payroll deductions

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. You can enter your current payroll information and deductions and.

Payroll Tax Calculator For Employers Gusto

This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings.

. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. Fine-tune your payroll information and deductions so you can provide your staff with accurate. Taxable income Tax rate based on filing status Tax liability.

That annual salary is divided by the number of pay periods in the year to get the. Statutory deductions should be calculated by the individual who will be processing the payments. Convert the MONTHLY cost into a PER PAYROLL cost.

Get Started With ADP Payroll. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. Ad Compare This Years Top 5 Free Payroll Software.

For example if an employee earns 1500. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. Estimate Salary Paychecks After Required Tax Deductions.

Free Unbiased Reviews Top Picks. You have nonresident alien status. Payroll Calculators will quickly calculate deductions taxes and pay for your paychecks.

Stop paying fees each time you process. Ad Calculate Your Payroll With ADP Payroll. Therefore we know there are 26 payrolls per year.

No more worrying about local laws complex tax systems or managing international payroll. To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year. Ad With Deel your business can easily hire employees in the US.

Explore Our Payroll Products. Use this calculator to help you determine the impact of changing your payroll deductions. It will confirm the deductions you include on your.

Estimate your tax withholding with the new Form W-4P. Free 2022 Employee Payroll Deductions Calculator. The calculator can help estimate Federal State Medicare and Social Security tax withholdings.

Computes federal and state tax withholding for. Subtract any deductions and. If the payroll processor is lucky the employer has a.

The maximum an employee will pay in 2022 is 911400. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. How to Calculate Payroll Deductions.

How to calculate annual income. Process Payroll Faster Easier With ADP Payroll. Use this simplified payroll deductions calculator to help you determine.

Adjusted gross income - Post-tax deductions Exemptions Taxable income. Get 3 Months Free Payroll. This number is the gross pay per pay period.

Process Payroll Faster Easier With ADP Payroll. Use Notice 1392 Supplemental Form W-4 Instructions for Nonresident Aliens. Take Advantage of Everything Payroll Has To Offer.

For example if you earn 2000week your annual income is calculated by. Ad Reduce Costs By Harmonizing Processes On A Single Payroll System. Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier.

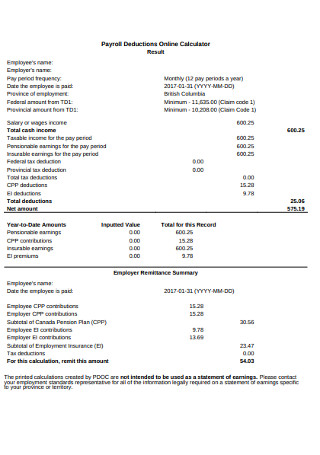

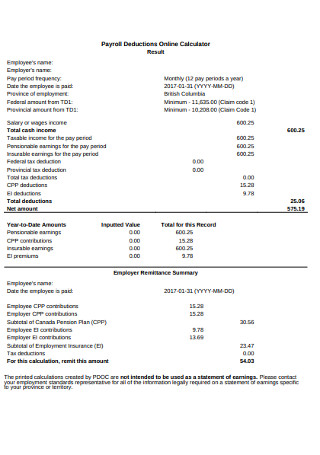

Get an accurate picture of the employees gross pay. Find The Best Payroll Software To More Effectively Manage Process Employee Payments. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

Use our free calculator tool below to help get a rough estimate of your employer payroll taxes. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Our Average ERC Client Receives over 1M.

In this example payroll is done biweekly. For example if an employee makes 40000 annually and is paid biweekly divide their annual wages 40000 by 26 to get their total gross pay for the period 40000 26. Get Started With Limited Offers Today.

Get 3 Months Free Payroll. Ad Get It Right The First time With Sonary Intelligent Software Recommendations. Get Started With ADP Payroll.

Ad Prevent Expensive Mistakes With Unlimited Guidance and Support From Uour HR Manager. Lets say the annual salary is 30000. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Ad Calculate Your Payroll With ADP Payroll. We Document Eligibility Calculate ERC Submit. 52 weeks per year every 2.

Ensure Accurate and Compliant Employee Classification for Every Payroll. A salaried employee is paid an annual salary. Ad Get Up To 26k Per W2 Employee No Revenue Decline Necessary Schedule Your Free Consult.

Solved W2 Box 1 Not Calculating Correctly

Paycheck Calculator Take Home Pay Calculator

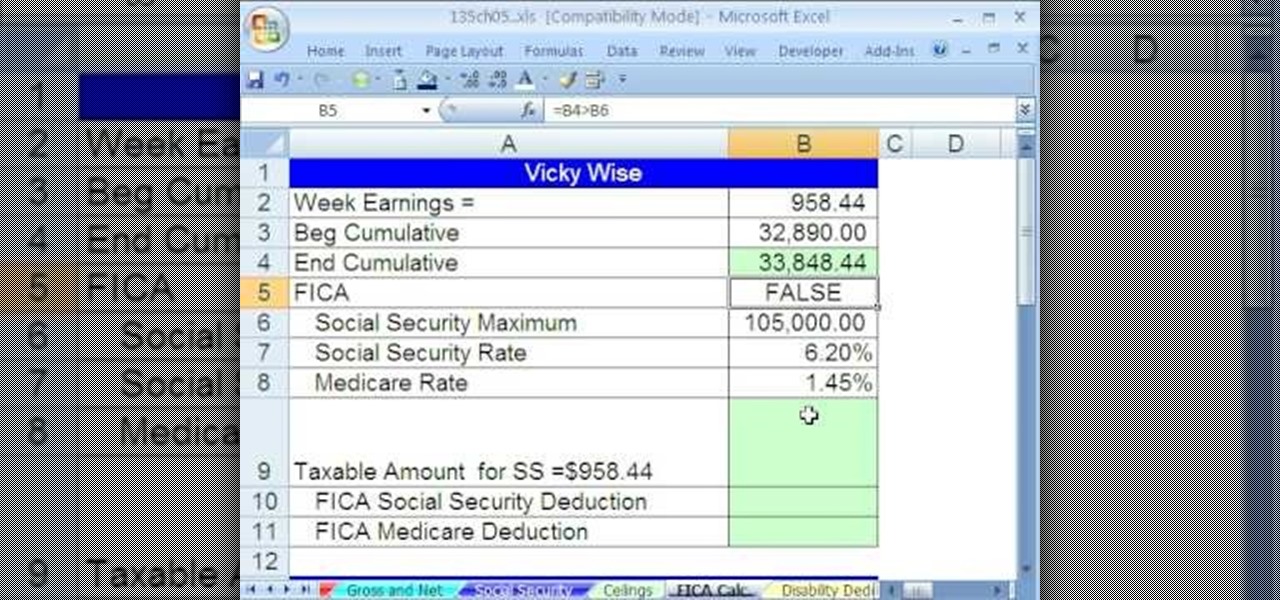

How To Calculate Payroll Deductions Given A Hurdle In Excel Microsoft Office Wonderhowto

Enerpize The Ultimate Cheat Sheet On Payroll

Mathematics For Work And Everyday Life

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Federal Income Tax Fit Payroll Tax Calculation Youtube

Opentaxsolver Payroll Deduction Calculator

How To Calculate Payroll Deductions Given A Hurdle In Excel Microsoft Office Wonderhowto

How To Calculate Net Pay Step By Step Example

21 Sample Payroll Templates Calculators In Pdf Ms Word Excel

How To Calculate Payroll Taxes For Your Small Business

Opentaxsolver Payroll Deduction Calculator

How To Use The Cra Payroll Deductions Calculator Blog Avalon Accounting

Paycheck Calculator Take Home Pay Calculator

How To Calculate Payroll Taxes For Your Small Business

How To Use The Cra Payroll Deductions Calculator Blog Avalon Accounting